Definition and Example of Private Mortgage Insurance

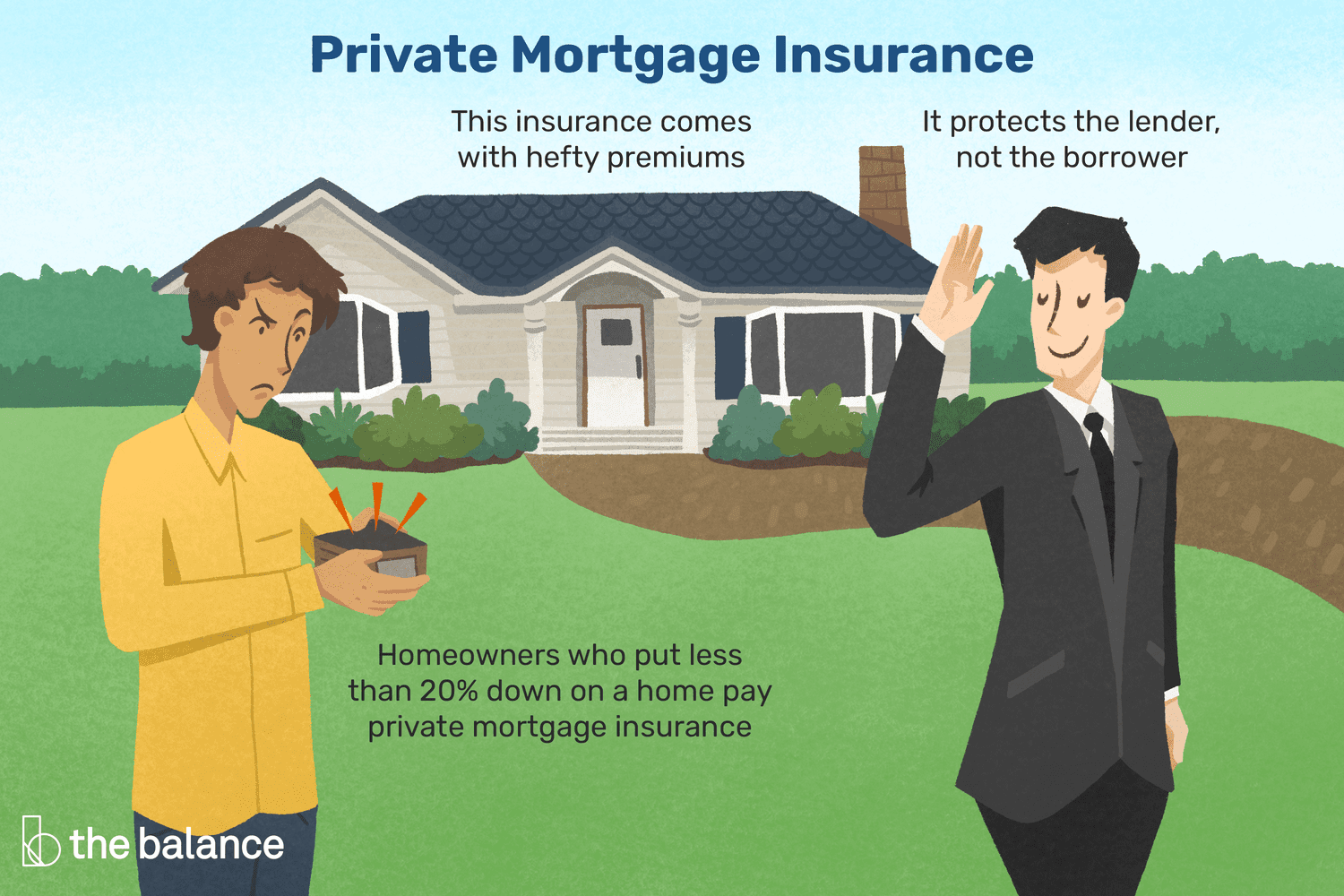

Private mortgage insurance has been a component of some home loans since 1957. It effectively guarantees the lender that its loan will be paid, so having such a policy in place can help some borrowers get approved for a loan they wouldn’t otherwise qualify for. This insurance is often required if you make a down payment of less than 20%.

note

Some lenders will allow you to make a down payment of less than 20% without paying for PMI, but these loans usually come with steeper interest rates.

How Private Mortgage Insurance Works

Like any other type of insurance policy, you’re paying premiums to cover damages should an unfortunate event occur. The insurance company is liable for paying off your loan if for some reason you find yourself unable to do so.

Lenders consider that this is more likely to happen if you have less of an ownership stake in the property. This would be the case if your equity were less than 20% at the outset because you didn’t put the much money down.

Private Mortgage Insurance vs. Mortgage Protection Insurance

PMI is different from mortgage protection insurance (MPI). Mortgage protection insurance won’t pay off the entire balance of your loan if you default, but it will make some payments for you for a while if you fall victim to certain covered hardships, such as job loss, disability, or serious illness.

| Private Mortgage Insurance | Mortgage Protection Insurance |

| Insures against total default on the loan | Covers some missed mortgage payments |

| Insures the lender | Insures the borrower |

| Pays in the event of foreclosure | May pay in the event of the borrower’s death, job loss, or disability |

| Is sometimes required by lenders | It is a voluntary election by the borrower |

Pros and Cons of Private Mortgage Insurance

There are both advantages and disadvantages to PMI. On the upside, it can make it easier to qualify for a loan, because it lowers the risk you present to a lender. They might be more willing to overlook a low credit score or smaller down payment. And premiums are tax deductible, at least through tax year 2021. This has been one of those ever-changing aspects of tax law that can change from year to year.

note

PMI also gives you more buying power. It lowers the down payment you’re required to bring to the table, which can be extremely helpful if you’re short on funds or just want a lower initial investment.

The main drawback of PMI is that it increases your monthly mortgage payment. It can sometimes increase your closing costs, too. Another downside is that mortgage insurance exists solely to protect the lender in case you default. It offers no protection for you at all if you fall behind on payments.

-

May increase your monthly mortgage payment

-

May increase your closing costs

-

Provides no protection for the borrower

Do I Have to Pay for Private Mortgage Insurance?

Avoiding PMI typically requires making a down payment of 20% or more. This isn’t true of all lenders, but it’s a good rule of thumb.

This type of insurance typically costs between 0.5% and 1% of your loan value on an annual basis, but the cost of PMI can vary. Your lender will detail your PMI premiums on your initial loan estimate, as well as on your final closing disclosure form. You can expect to pay your premium either upfront at closing, monthly as a part of your mortgage payments, or both.

The good thing about PMI is that it’s not permanent. You can typically request that your PMI be canceled and removed from your mortgage payments when you’ve built up 20% equity in your home. The process for this varies by lender, but the request must always come in writing. It often requires another appraisal of your home.

Reach out to your lender as you near the 20% mark, to get full details on how you can cancel your PMI. Your lender is required to terminate PMI on your behalf once your balance falls to 78% of the home’s value, but you must be current on your payments before they can cancel your policy.

Key Takeaways

- Private mortgage insurance (PMI) protects lenders against potential default by borrowers. It will pay off the mortgage balance in the event of foreclosure.

- PMI is often required when homebuyers make less than a 20% down payment on the loan.

- This insurance offers borrowers a better chance of being approved for a mortgage if their credit is less than stellar, or if they don’t have a lot of money to put down.

- PMI is usually included in mortgage payments, so it can make them higher than they otherwise would have been.

Thanks for your feedback!